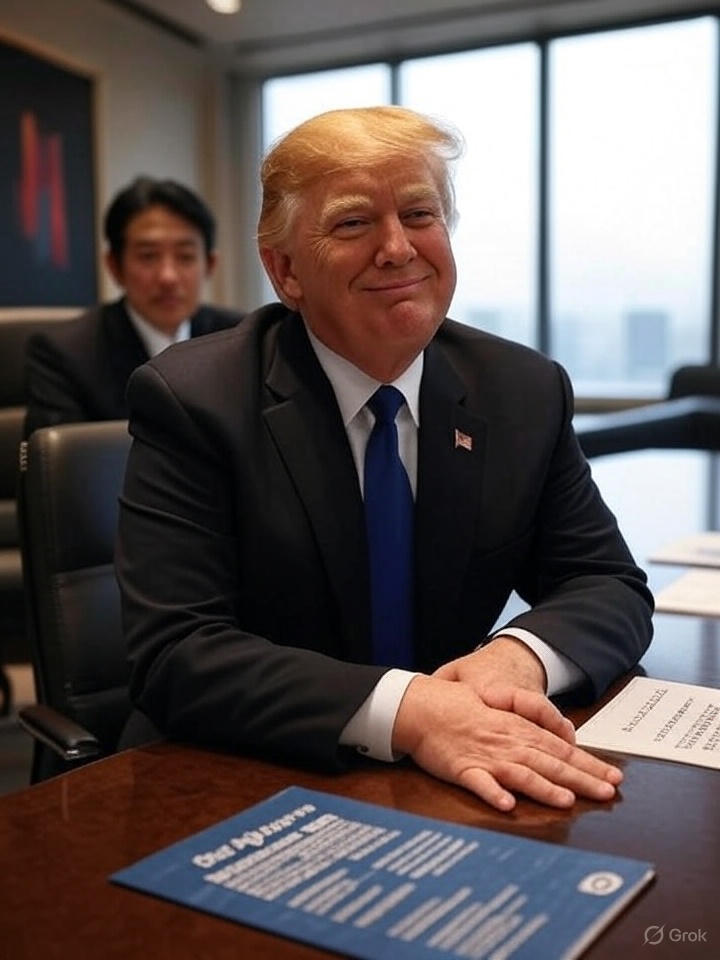

In a major trade breakthrough announced on July 23, 2025, President Donald Trump unveiled a trade agreement with Japan that significantly reduces threatened U.S. auto tariffs cutting them from up to 27.5% to 15% alongside broad reductions on other Japanese imports. The deal also includes a $550 billion Japanese investment package and agricultural concessions, signaling what Trump hailed as “the largest trade deal in history” for the U.S. (Reuters, Wikipedia).

Key Features of the Deal

1. Tariff Reductions

- Automobiles & parts: Tariffs drop to 15% from a combined rate of 27.5% (10% baseline plus 17.5% threatened sectoral) (Reuters, Reuters, Japan Wire by KYODO NEWS).

- Other Japanese imports: Also reduced to 15%, down from a previously announced 25% (AP News).

2. Japanese Investment

- Tokyo agrees to direct $550 billion in investment and financing toward U.S. industries such as aerospace, semiconductors, and LNG dubbed the “Japan Invest America Initiative” (Reuters).

- Includes a commitment to purchase 100 Boeing aircraft and boost defense related spending from $14 billion to $17 billion annually (Reuters).

3. Agricultural Access

- Japan to increase its rice imports, expanding the WTO “minimum access” quotam without compromising its domestic farm protections (Japan Wire by KYODO NEWS).

Economic & Market Reactions

Markets Rally

- The trio of Tokyo stocks, European indices, and U.S. futures rose in response: Japan’s Nikkei surged ~3.5%, driven by automakers like Toyota and Honda, which leaped 14% and 11% respectively (Reuters).

- Analysts attributed gains to the certainty the deal brings, calming fears of disruptive tariff hikes (Reuters).

Global Economic Impacts

- Economists view the 15% tariff across auto imports as a “manageable” level that avoids the strong global disruptions feared under higher tariffs (Reuters, Globedge).

- This deal is seen as a template for other negotiations, with the EU and China under pressure to get similar terms before pending Aug 1 deadlines (Reuters).

Political & Strategic Context

Bargaining by Trump & Ishiba

- Japanese Prime Minister Shigeru Ishiba achieved a concession rarely granted to U.S. trading partners down from Trump’s proposed 25% auto tariff, a significant sectoral rollback (Reuters).

- Japan, which previously faced a national trade deficit (~¥2.2 trillion H1 2025) and an 11% export drop, viewed the agreement as vital economic relief ahead of domestic elections (AP News, Reuters).

Importance of the August 1 Deadline

- The U.S. had set an Aug 1 deadline to impose 25–35% tariffs on Japanese autos and other imports, unless deals were finalized (Japan Wire by KYODO NEWS).

- With this accord, Japan avoids punitive tariffs, while Trump frames the deal as proof of his “America First” negotiation success (The Washington Post, Japan Wire by KYODO NEWS).

Broader Trade Policy Implications

- Ratcheting up global baseline tariffs: With blanket tariffs of 10–15% being sent to over 150 countries, these bilateral deals could standardize this higher floor (The Wall Street Journal).

- Pressure on other nations: The U.S. Japan deal escalates pressure on nations like China, EU, South Korea, Philippines, and Indonesia to secure similar arrangements before deadlines (Reuters).

- Distortion of global trade norms: Observers see Trump’s willingness to negotiate sector specific tariff adjustments as breaking traditional U.S. trade treaty structures warning foreign firms that all rates may be renegotiable (Reuters, Wikipedia).

Final Analysis

In summary, President Trump’s July 23 trade framework with Japan delivers a strategic yet striking recalibration of U.S. trade policy. The halted tariff escalation (from 27.5% to 15%) gives Japan’s car-sector the broader economy an essential reprieve. Meanwhile, the $550 billion investment commitment, particularly through Boeing aircraft purchases and defense-oriented deals, enhances U.S. industrial and employment metrics.

Market response was swift and positive, with Tokyo stock values bouncing and global indices gaining optimism. Economists see the 15% tariff level as disruptive but tolerable helping stabilize global supply chains and investor confidence ahead of an extended Aug 1 deadline. Significantly, this agreement sets a benchmark for future Trump-era trade pacts, especially as the administration solicits similar frameworks from China, the EU, and other trading partners.

Politically, the deal bolsters Trump’s image as an assertive dealmaker, while Japanese leader Ishiba averts economic disruption and potentially political fallout just ahead of national elections. However, the targeted feature of the deal marks a departure from multilateralism; instead, it underscores a bilateral, transactional approach where every sector’s tariff is negotiable.

In coming months, attention will shift to whether Trump secures comparable arrangements with other major economies. For global businesses especially in autos, agriculture, technology, and defense the deal signals both an opportunity and risk: tariff relief is achievable, but only through direct negotiation, not by assumption.

💡 Bottom line: The U.S. Japan deal delivers immediate economic relief and sets a global trade policy template, but it also marks a more fragmented, bespoke and potentially unpredictable new era in international trade relations.